Insurance Dividends: A Look Back at the 2008 Market Crash

During the 2008 stock market crash, mutual insurance companies outperformed many other financial institutions. This was attributed to several factors:

Managing Long-Term Care Expenses in Washington

States have consistently taken a straightforward approach to Medicaid cost recovery: shifting part of the financial responsibility to the Medicaid beneficiary through Medicaid's asset and income spend-down rules. These rules require beneficiaries to deplete nearly all personal income and assets in exchange for Medicaid coverage of long-term care needs.

Understand the Facts about Long-Term Care; It Affects Everyone!

Long-term care insurance can help protect individuals, their families, and their assets against the potentially catastrophic cost of extended care by providing the funds to meet expenses when the time comes.

Do Not Overlook The Power of LIRPs

A Life Insurance Retirement Plan (LIRP) is a versatile financial tool that combines life insurance protection with a tax-efficient cash value component.

The Rise and Fall of Pension Plans Part 2

The Retirement Crisis is a global emergency. To understand why our retirement system is failing in the United States, it is best to understand what other countries are doing better than we are.

The Rise and Fall of Pension Plans: Part 1

Remember the golden days when a job at a reputable company meant more than just a steady paycheck? It was a ticket to a secure future, with promises of a pension that would ensure financial stability long after the working years ended.

Personal Advice That Made a Difference

After a compelling discussion over a cold beer and napkin doodles, I took his advice.

Life Insurance is no longer just a Death Benefit!

Whole life insurance is critical in creating a basis for long-term financial security

Don’t Fall Into the Group Life Insurance Trap

While group life insurance provided by employers might seem like a convenient safety net, its temporary nature often leaves a gap when you make the inevitable leap to new opportunities.

Demystifying the Annuities Market

Despite their appeal, annuities can be complex and confusing for many investors.

Choosing a Financially Strong Insurance Company

Choosing an insurance company with strong financial strength ratings is essential for ensuring that your claims will be paid promptly and efficiently.

Insurance Companies Financial Strength

Unlike many other sectors, insurance companies operate on a business model rooted in prudence and risk management.

Using The Rule of 100 to Reduce Risk

Welcome to the world of The Rule of 100, a guiding light for retirees who want to embrace financial security without sacrificing growth potential.

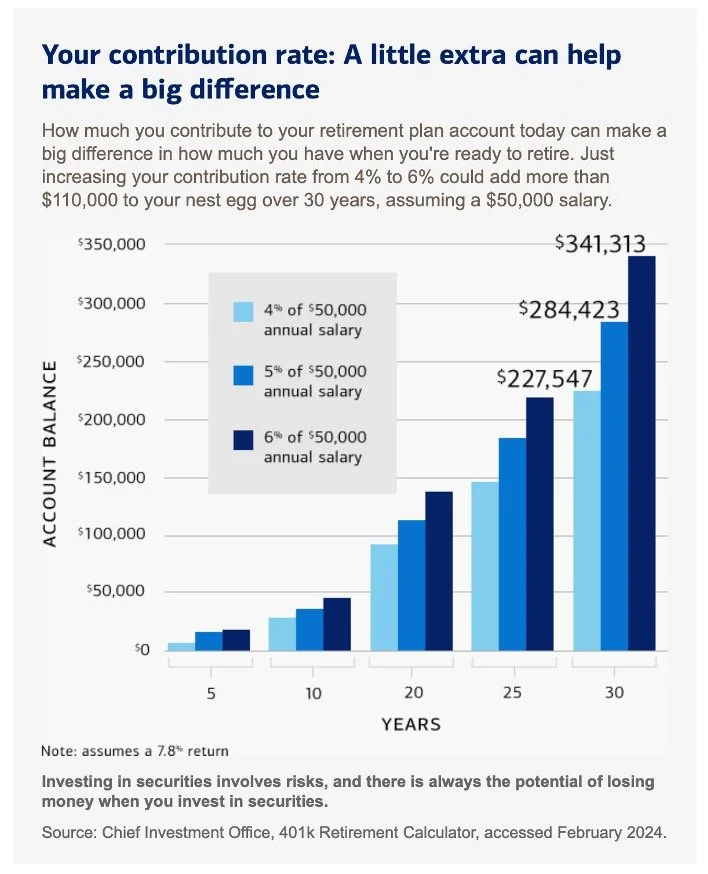

How much Young Adults need to save to retire at 65

While having a clear retirement savings target is beneficial, the fluctuating nature of the market can make achieving this goal seem daunting.

Learning from the 2008 Recession and Its Lessons

The repercussions of the 2008 recession were felt far and wide, shaking the foundations of financial security for millions. Retirement dreams were shattered as 401k balances plummeted.